These experts, with their keen eyes for market trends and financial prognostications, have provided valuable insights into the future trajectory of this automotive technology company. In the realm of equities research, analysts have been closely examining and assessing the performance of Luminar Technologies (NASDAQ: LAZR) shares. Show more Luminar Technologies: Analyst Evaluations, Insider Transactions, and Financial Performance As the company continues to evolve and expand its offerings in the automotive technology sector, investors may find themselves presented with a compelling opportunity for long-term capital appreciation. Moreover, the interest shown by institutional investors and hedge funds further reinforces the belief in Luminar Technologies’ potential for success. The positive sentiment towards the company is underscored by the buy rating from the majority of analysts and the target price set by brokers. has received a “Moderate Buy” consensus rating from various ratings firms. In conclusion, Luminar Technologies, Inc.

#Luminar technologies ipo software

These strategic moves indicate that these investors see promise in the company’s sensor technologies and software solutions, positioning it for potential growth and profitability.

The growing interest from institutional investors highlights Luminar Technologies’ potential as an attractive investment option within the automotive technology industry. MGO One Seven LLC also entered into a new position with the company during the same period. increased its holdings by 7.4% during the fourth quarter, while State of New Jersey Common Pension Fund D boosted its position by 13.0%.

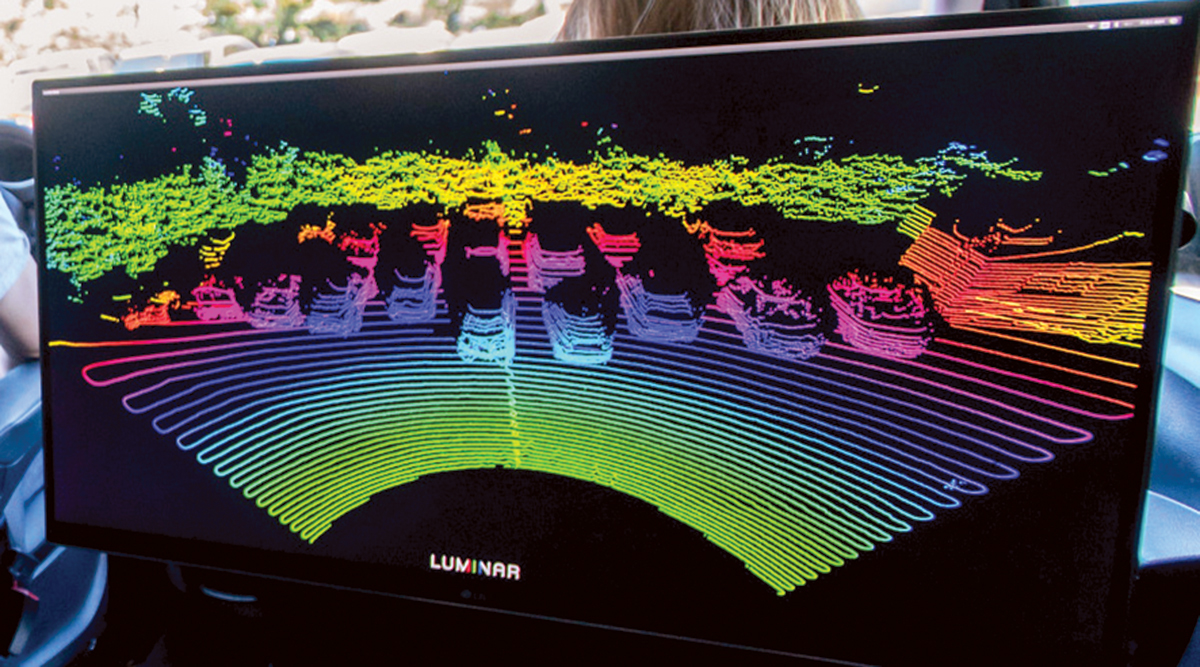

It is worth noting that various institutional investors and hedge funds have recently made adjustments to their stakes in Luminar Technologies. These offerings primarily target original equipment manufacturers in industries such as automobiles, commercial vehicles, robo-taxis, and related sectors. The Autonomy Solutions segment focuses on designing, manufacturing, and selling laser imaging sensors or lidars, along with perception and autonomy software solutions. Luminar Technologies operates in two segments: Autonomy Solutions and Advanced Technologies and Services. This suggests that there is significant upside potential for investors who choose to buy shares at their current valuation. This positive sentiment towards Luminar Technologies is indicative of the confidence placed in the company’s potential for growth and success in the market.įurthermore, brokers who have analyzed Luminar Technologies over the past year have set an average twelve-month target price of $12.42 for the stock. The ratings firms that have covered Luminar Technologies are comprised of one research analyst who rated the stock as a sell, two others who issued a hold rating, and an overwhelming majority of five who gave a buy rating to the company.

The company, which specializes in automotive technology and provides sensor technologies and software for vehicles, has garnered the attention of analysts and investors alike. (NASDAQ: LAZR) has received a “Moderate Buy” consensus rating from eight different ratings firms. In a recent report by Bloomberg, it has been revealed that Luminar Technologies, Inc.

0 kommentar(er)

0 kommentar(er)